Impulsive waves are clearly much easier to count than corrective waves. The question of course is this truly impulsive?

I have posted a bearish count here and briefly describe why I don't have a bullish count (of course as I'm posting this, I think I can provide a bullish one. If I find some time I will).

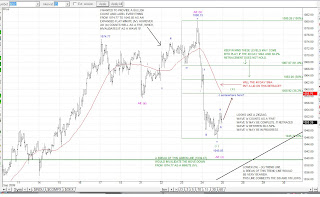

Price is coming up on some pretty important trend lines. The green and black (significant) ones on the chart need to be watched.

A break of the green would rule out the bullish count (that being a Minute iv expanded flat), since that would create a 4-1 overlap. A break of the black line would be pretty bearish since this is the lower trend line connecting the 3/9/09 low and 7/8 low.

If the move off the 9/23 top is truly impulsive, it completed five waves today at the 1045.85 bottom. It appears an a-b-c correction (specifically a zigzag) was in progress into the close.

If wave 'a' is complete, I also see 'b' complete. All that is left is wave 'c' towards the retracement levels. Will the 40 day SMA hold it down?

I did not plot the 10 day SMA but on the daily chart, the 10 day SMA = the 40 SMA on the 15 min chart.

If the correction into the close turns out to be a zigzag, it further strengthens the case that it would be a wave 2 since wave 2s are typically ZZs. If it is a wave 2, watch out because a wave 3 will follow and most likely pierce through the green and black lines.

I will also mention that if today's bottom was Minute iv the following would be targets for Minute v:

Minute v = i = 1106

Minute v = .618 x i = 1083

No comments:

Post a Comment