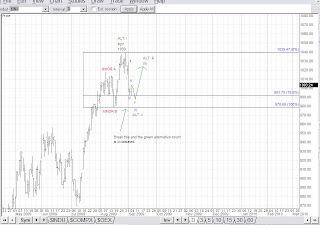

Here is a another attempt at these squiggles. This may make sense but who really knows at this point.

I am counting the spurt at the end today as the final wave c of Y of iv. Here are some targets for c as it relates to wave a (blue).

1003.43 = c at a possible previous fourth wave extreme

1007 = c = 1.618 x a

1014 = c = 2.618 x a

It is possible that wave c did complete today. If the previous fourth wave count is correct, this would fit well with the behavior of wave 4s. Plus, wave c is greater than equal to wave a. If it is not, I will be looking at the levels mentioned above.

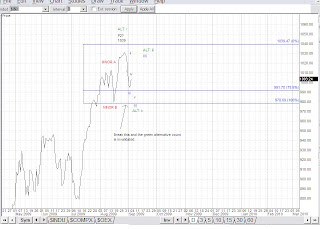

Chart 2

I took a look at the daily chart because I have mentioned in the past it helps to take a few steps back to see what the overall picture looks like. Of course from this I still see two potentials in either direction.

Potential 1:

Based on form alone, the structure appears to be developing a five subwave structure. Whether this is impulsive or corrective, it is implying that there will be more downside to come.

If impulsive, this looks like it would be completing wave 1 at a higher degree. Naturally we would expect two more impulsive waves down (3 and 5). If this were true, price would certainly break below the 978 low redndering the alternate count invalid.

If this were corrective, the 5 subwave count would imply that a zigzag was in the works. Again, I would expect one more wave lower (for wave c), which would most likely take out the 978 low and again render the alternative counts invalid.

Additionally, if this wave were corrective, it would require a complete recount. That I won't even attempt unless it is warranted.

Chart 3

Lastly, this may not mean anything but looking at the charts in different ways may shed some light on things. Prechter, in The Elliott Wave Pricinple, mentions that R.N. Elliott liked to keep tabs on the hourly close charts. I am assuming this would be very similar to a line chart.

Given this depiction of price, it appears that all we are seeing from the top is the development of one wave down with a second beginning to correct it. I believe this is not the best way to interpret waves because it does not capture the intraday highs and lows and ultimately may distort the count.

However, I would argue that it may still provide a little assistance when one seeks a little clarity. Notice the form of Minor A and B. The line chart still correctly presents the structure in form.

Just some things to think about.

thanks for the bullish count, it will trigger!

ReplyDeleteby the way iv ended yesterday at 1004.4

we are now on a hard move up leading us over 1100

ha ha ha ha ha ha ha ha ha ha ha ha

ReplyDeleteohmy!!!!!!!!!

ha ha ha ha ha ha

ouch!!!!!

ha ha ha ha ha ha

does it hurt? how much? ohmy...

is it a bold market? hurts?

ha ha ha ha ha ha ha ha ha ha ha ha

pffffffffffffffffffffff

wave, do you live from trading or you do this for fun?

ReplyDeleteif you do live from trading, i will like to give you an advise to earn money.

Forget of counting waves in a corrective move.

Other kind of analisys work better.

ok, here i wait for your answer i made 12% since tuesday. There is not a lot of upward movement for this stock, just another 12% maybe before it comes to light.

Jose,

ReplyDeleteI do not trade for a living. I do this because I do enjoy counting waves (I guess that is sick).

You are right though, it is probably not worth counting corrections since they are difficult to do. Probably easier to wait til an impulse is clear to jump into a trade.

ok, i live from trading.

ReplyDelete