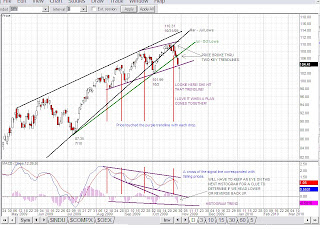

Don't you love it when a plan comes together? I posted this chart for the SPY, DOW and SPX several days ago. Click here for post.

Coincidence or not, price behaved accordingly and this turned out to be a very nice trade.

Now where do we go from here? I still believe there is more room to the downside, however, we may see a slight reversal back up tomorrow to possibly test 1060 (max) and complete a minuette (iv).

If the count on the SPX chart is correct, then further lows lay ahead. By my count, we are only in minuette (iii)(and this could possibly be at minute degree) of minute [i].

Also keep in mind, price fell right on that purple trendline. If the pattern continues as it has in the previous 3 months, we may still be setting up for a reversal back up to complete a possible minute [v] (this is an alternative bullish count BTW).

We will have to keep an eye on the MACD histograms tomorrow to see if a new lower bar forms after today's close. If so, that may indicate we have bottomed on this trendline (purple) for now and I would expect some more upside to come.

But I will say I'm leaning more towards the "a top has been put in" camp. I'm still not going to say P3 has begun, but this is surely a good start for a nice trend reversal.

The next two days will be very telling.

I removed some alternate counts I previously had after today's action. However, there still is one on the docket and with today's close we may have potentially completed minute [iv}.

No comments:

Post a Comment