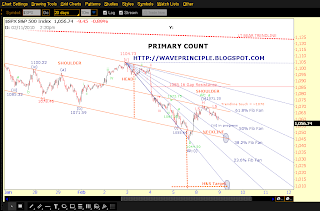

Obviously there is no certainty in wave counting. As you are all probably well aware we had various counts going into today.

The two main counts were that minuette (i) of [iii] bottomed at 1055.64 and an expanded flat for (ii) was in the works. This was my primary count. The other count had minuette (i) of [iii] bottoming at 1044.50 and a zigzag a-b-c for wave (ii). Those going with option 2 were expecting a retrace to 1080s.

Going in to today, I was quite confident of my count (i.e. I assigned it the highest probability) and it was based on other factors that indicated to me that 1072 would be tops. I laid this out in this post.

In the end, between the two counts, I don't think it really mattered which one was right. Ultimately, both counts pointed to the same area, though many were expecting a 1085 print for (ii). But again, I believed it was less likely based on the channels, wave relationships and a recurring H&S pattern formation I am seeing as we move lower.

I think it is fairly safe to say that wave iii of (iii) may be underway and looking like it is already extending as would be expected. There are some H&S targets I am looking at for this leg down.

The top chart is the overall view. The bottom chart is my squiggle count I have thus far.

There are a few ways to count this but I didn't want to crowd the chart with labels. Just keep in mind that some adjustments (as usual) with the labels and the degrees may have to be made.

I am beginning to notice that the H&S formations are following through more often now. Have you seen this chart?

This was the large ultra bearish H&S formation I have been tracking. If you want to follow the progress of this chart, just click on the Bearish Head and Shoulders link in the labels section to the right. I will have to update the chart again.

The nested H&S formations just seems like it is the right formations, especially if we are unwinding this 10 month rally in this P3 wave down. Notice the larger H&S possibly forming on the top chart. 1010 is looking like a target there.

The fib fans may also provide a reference as to where key support levels may reside. On the top chart, I highlighted, with the circle, an intersection of the fib fans and trend channel and the H&S targets. These are interesting levels to keep an eye on.

One bullish alternative to this count is that the pullback lower today is part of a wave b from the 2nd option I discussed above. If this alternate count is correct, it would imply a wave c higher would be expected next.

If this alternate played out, I would expect wave c to target 1072 and mostly likely no higher. A move to 1072 would make wave c=.618a, which is a very typical wave relationship.

A reminder of the chart below also compels me to think that 1072 will be tough to crack.

As always, we shall see.

The counts suggest that a iii of (iii) is imminent. I'll try to get some squiggle counts to you a little later.

In the meantime here's something to chew on. I don't think we are going to get over 1072 because:

1. 1072.31 was a gap up on 11/9/09.

2. We filled that gap on 1/29/10 at 1071.59 and it bounced, serving as support

3. We tested it again on 12/4 and broke thru and it backtested this for the majority of the day only to head down to 1044.

4. We tried get there again today but failed at 1071.20.

Ultimately the wave count (my opinion) supports this view that the odds are greater we will not see it again. I do have an alternate count that has us re-visiting it but not breaking back above meaningfully.

Check back later.

Hi Grand. I also highly expect that (iii) may be underway. I have not done a micro count on the SPX, but, FWIW, I just posted one for the NYSE that seems to translate reasonably well. I suggests that we completed i of (iii) with an extended fifth that will retrace in a sharp ii tomorrow morning, followed by a HARD reversal into iii.

ReplyDeleteThanks for looking Blankfiend. I will skip over to your blog to take a looksie. One thing I forgot to mention in my post is that i have been primarily using macd, actually only. it actually works well for me. so far, all times still show a downtrend in place. the 30 and 60 mins are on the verge of a cross, which leads me to believe that we will see extensions lower of the iii of (iii). once again, we will see in the am.

ReplyDelete