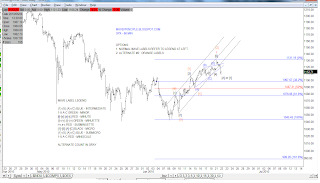

SPX 60 MIN

Just wanted to add this chart that includes a potential support level at 1105-1106. The market is almost there. Let's see.

SPX - 60 MIN

That was a nice little reversal today but should not have come as a surprise given a few of the wave counts coming into today. We got the thrust out of the triangle or throw-over out of the ending diagonal and saw a reversal just after halfway through the day.The market remains above it's 200 day MA.

Here's a follow up to the chart I posted on Friday. I was able to eliminate the gray options.

A bullish view has a subminuette ii retrace in the works, while a bearish view has the beginnings of a third wave down.

If a subminuette ii down is in the works, I would anticipate a turn at the Fib retrace levels of 1097-1076 (38-62% respectively). The 50% retracement level at at 1087 looks like a good target since this lines up with the middle bollinger band (daily).

If a third wave down is in progress, then a new low should be made.

Earlier in the CiL I commented on the fact that the squiggles for some reason appear to look like a bunch of waves 3 and 4. It is possible this structure is still trying to stair-step it's way higher. The chart below highlights this possible view:

SPX - 15 MIN OPTIONAL

SPX - DAILY BOLLINGER

We'll see what tomorrow brings.

No comments:

Post a Comment