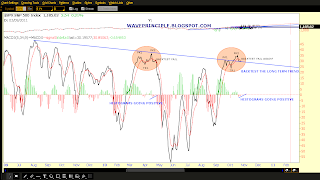

Here is a look at the MACD daily going back to 8/2009. This may get the bears excited but then again, the bulls may get excited as well. You decide.

The case for the bulls:

Currently the histograms are sloping towards zero and the signal line is turning up right where it is backtesting a long term trendline that was rejected twice in September but then broke through in October.

The case for the bears:

Turn your attention to the ovals I have placed on the chart. They highlight a similar pattern that may be repeating right now. Look at the two ovals I have placed to highlight a potential pattern that may be repeating. The first oval represents the the setup towards the April-July decline .

Notice where I have the peaks (PK) labeled and the trough (TR) as well as the failed backtest.

Makes you wanna go hmmm....

EOD Update - 5:50 PM

Here's a channel I've had my eye on as well. I was speculating that the market may try to tap the upper channel before it's reversal.

I also like viewing the waves through different charting tools. It sorta helps to see it differently. And yes this is a slightly different variation to the count as well.

The top of the channel just so happens to hit 1203ish and up. We'll see.

I haven't been following along but read that tomorrow is a POMO day. Maybe that's the final push the market needs to hit the top.

EOD Update

Ok. It looks like the market found support at the top of the previous range at 1185. One thing I will not deny though is that there is a possibility this rally leg up may have completed today at 1195.35.

I apologize in advance if my 1st chart is too hard to follow. I had to incorporate most of the labels to show the main options I am looking at right now. I would have preferred to have shown my thoughts with the StrategyDesk platform but I just don't have access to it right now.

I believe there are three to follow:

1. We completed or nearly completed wave (4) of the wave (v) ending diagonal at the close

2. We are currently working on wave (C) of the triangle.

3. The rally since 8/27 topped today.

According to option 1, wave y of (4) =.618*w of (4) at the close. Wave (4) has also retraced (3) 38.2% and managed to stay above the trendline using the 10/19 and 10/21 lows.

Based on this option, I am expecting wave (5) starting around tomorrow. This count losses momentum if the market breaches 1171.17 and is completely out if 1159.71 is taken out.

Based on option 2, we completed wave (B) of the triangle at today's high. The pullback that ensued is wave (C) in progress. This count is out if we breach 1159.71

Based on option 3, we topped today and should expect a reversal that will take out 1171.17 and 1159.71.

So in summary, the first area below to watch out for is 1171.17, which the market may signal that the top is in. However, I'm still leaning towards a move higher towards 1200-1218 to complete wave (v).

I have to run for now but will try to add to this post later.