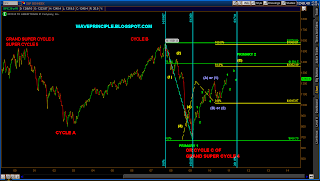

[Edited 12/12/10- Added a Minor 4 Combo Corrective Option and a Long Term count below]

Did that get your attention? Not sure at the moment exactly where the market is heading but several of my charts below indicate that the market may intend to climb there. I'm not saying this is what I want and hope for (but of course I would welcome it if it happens) but just saying this is how I interpret the charts.

Though this rally may be long in the tooth, I'd say the larger trend remains bullish.

I am dumping these charts for you to decipher and will come back and address each one later if they don't make sense on their own.

I want to say that minute [i] of Minor 5 is nearing an end but there are still several options on the table. One such option is the Minor 4 Flat or combo corrective that I would say is the best alternate (from a slightly bearish perspective) at the moment.

|

| SPX - Preferred [Edited 9:30 PM] |

|

| 3 Min [Edited 9:30 PM] |

This count implies that the market is still working on subminuette iii of minuette (v) of minute [i] of Minor 5. A Fib extension of subminuette iii to subminuette i looks to target 1245ish.

|

| Weekly Bollinger Bands |

|

| Bull Channel |

|

| Cup and Handle |

Minor 5 = Minor 1 at 1292.

|

| Fib Fans |

If the market shot straight up to the next fib fan above (62.8%), it would target approximately 1292.

|

| Reverse Fibonacci / Fib Confluences |

The next Fib confluence targets approx 1290. The confluence is not as tight as 1232 but I believe it shouldn't be ignore when considering other factors pointing to this level.

|

| RUT |

|

| TZA |

|

| Minor 4 Flat Alternate Option |

This option is still possible here as an expanded flat. If this option were to play out, the red Fib extensions would be the logical targets for minute [c].

|

| Minor 4 Combo Corrective Option |

Minor 2 took one month to complete. Minor 4 would take two months to complete and tag the lower channel if a flat/triangle combo formed. If this option were to play out, I believe 1200 would be the support level for the triangle.

Even this long term count supporting EWI's bearish count, implies that 1350 may be the intended target. You may have seen this chart a few times now as well.