[3:53 PM Update]

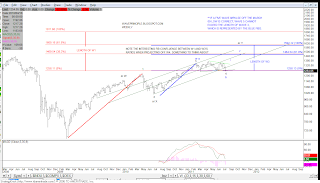

Below are the remaining bullish counts.

This bullish count remains valid so long as 1220 holds.

This bullish count remains valid so long as 1220 holds.  This chart is a corrective count but the red labels would call for a new higher once this consolidation completes.

This chart is a corrective count but the red labels would call for a new higher once this consolidation completes. [3:35 PM Update]

I added the Fib retrace levels. A nice Fib confluence resides near 1150.

Earlier I mentioned that we may have seen the top but keep in mind that top could be just five waves up of a wave 1/A of one higher degree.

A more bearish pullback as a result of this H/S would result in a wave 2/b. How this all fits into the bigger picture I'm still not too sure. Check back later for that.

EOD Update

The triangle count I have presented for quite some time now is nearly out. The minor 5 in progress count I recently carried as the primary is out. Things appear to be quite bearish at the moment.

With that said, I am still watching what happens at 1250. It is still very possible that the market trades within the 1250-1270 range as it consolidates before moving higher.

However, with the neckline break below the head and shoulders pattern and a close below the 200 day SMA, we must consider that the top may have been put in on 7/7/11. What top that is exactly is yet to be seen.

I have other ideas on some possible counts that may accommodate a new high. However, the bottom chart below is something I am truly considering as the end to Minor 5 for now.

Stay tuned for the other counts.