Here's an update on a collection of longer term charts I have been tracking. Based on my interpretation, the bulls are still looking good. However, bulls should be keeping an eye on some near term resistance.

Have a great weekend!

|

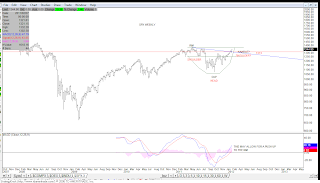

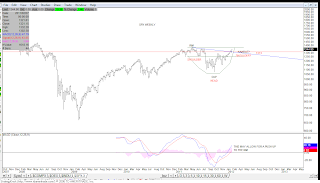

| SPX - PRIMARY DAILY |

Intermediate (B) has met the minimum 90% retracement of (A). However, as you will see below, the bullish alternate is certainly worth watching.

|

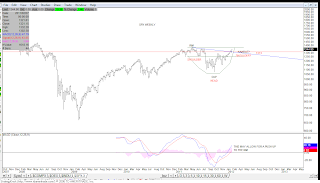

| SPX - WEEKLY |

A large cup and handle / inverted head and shoulders I have been tracking. Bulls may be taking a stab at the upper edge of the rim at 1370.

|

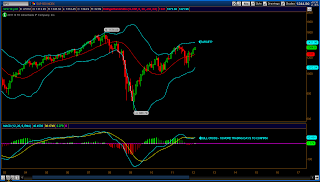

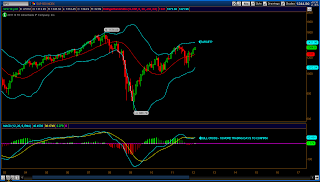

| SPX - 3 PUSH PATTERN |

A 3 push pattern I continue to track. Notice the channels and trendlines that have been overcome by the bulls.

|

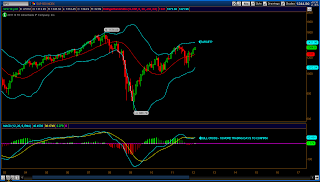

| SPX - MONTLY BOLLINGER BANDS |

A montly MACD bulls cross and upper BB at 1421.

|

| SPX - LT CHANNEL |

More channels.

|

| DJI- |

The Industrials are just 13.77 points away from matching the 5/2011 high.

|

| NDX |

The Nasdaq 100 is leading the way.