The market broke down out of the 15 min channel I have been tracking. As you will see below per the "rainbow" count there are still several options.

Lets look at the bigger picture first and work our way down.

|

| SPX Daily Primary |

For the primary daily count, I consider minute [3]/[c] complete and at this time trying to determine how minute [4] will play out. Originally, I had intermediate (B) complete as an option as well, however, I don't believe that is the case since the wave structure from 1378-1340 counts best as a corrective.

|

| SPX - 60 Min |

On the 60 min chart, we'll treat the decline from 1378-1340 as a wave a and the rally from 1340-today as wave b or wave a of b.

The rainbow count below highlights the other options.

|

| SPX - 60 Min Rainbow Options |

Red count - Minute [5] in progress with wave 1 of [5] completed today.

Blue count - A flat in the works for minute [4]. Unknown at the moment if wave b of [4] is complete though since it counts best as a impulse up.

Green count - Minute [4] turns into a triangle.

|

| SPX - 15 Min |

A closer view of the rally from 1340-today. I can count five waves down off today's high out of the channel so we'll see how far this pullback goes.

How deep depends on which rainbow option is playing out. Note the possible right shoulder setup near 1365-1360.

|

| SPX - Daily McClellan Oscillator |

Lets keep an eye on the McClellan oscillator breadth thrust. Should one of the pullback options from the rainbow counts occur, we may see a +ve divergence on the McClellan that also lines up with a thrust into +50 coming from -87. This would signal a new breadth thrust.

|

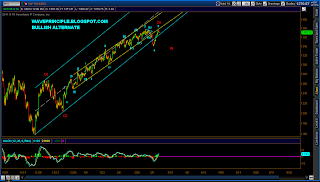

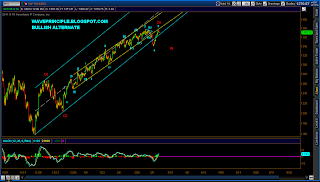

| Bullish Alternate |

Earlier I posted this additional bullish alternate in the CiL. I'm not too sure about this one anymore but wanted to post it again. Lets just keep that in our back pocket for now.

Have a great weekend!