5 Min

5 MinI've added a 5 min squiggle count here. It's not the most satisfying count but we'll go with it for now since it "looks" decent on the 60 min chart as well.

Remember to just keep in the mind the fact that this could still very well be an a-b-c (again replace 1-2-3 accordingly) to form a larger degree wave w.

EOD Update

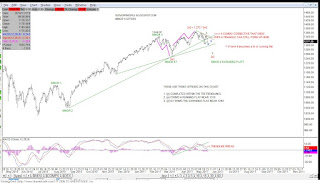

So far so good. Things appear to be playing according to the script. The Minor 4 chart remains the primary chart and count. One thing that will need to be consider is if Minor 5 is underway.

It's not overly important at this juncture whether it's a wave [d] in progress or the beginning of Minor 5.

60 Min

Looking for the first five waves up which either represents wave a of [d] or 1 of Minor 5. If the above count is correct, I expect wave 3 green to reach no greater than 1351 since wave 5 red can't be longer than wave 3 red.

One thing to keep in mind with this count. Though I label it 1-2-3 in green, it may easily be replaced with a-b-c and represent a larger degree wave w of a zigzag up for wave [d] of the triangle option. So just keep that in mind if you are trading this short term and want out before a pullback.

Perhaps the top of the BB is a target?

This count, though technically not dead, is pretty much a dead deal IMVHO.