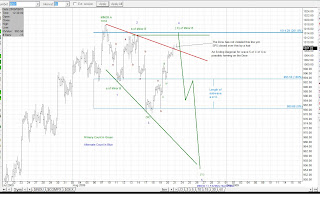

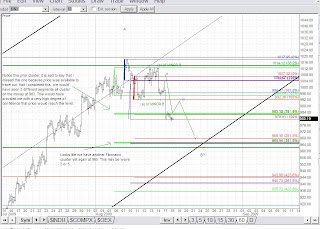

P2 Channel

P2 Channel Wave (Y) Channel

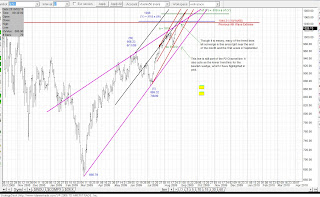

Wave (Y) Channel P1 Channel

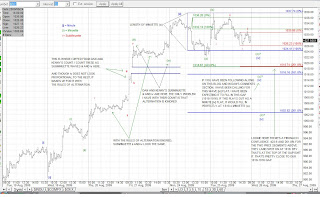

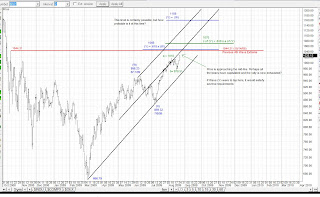

P1 ChannelPerhaps channel lines and Fibonacci relationships for P2 and Wave (Y) may provide some perspective. Both may indicate where one may expect Wave (Y)and P2 to end.

Do you believe this rally is now getting tired? If so, the P2 mid channel and Wave (Y) upper channel line may provide a clue as to where Wave (Y) or P2 tops.

If you believe this rally has room to run, the P2 upper trend line may provide a clue. A move towards the P2 upper trend line would place price near 1159 or (Y) = (W).

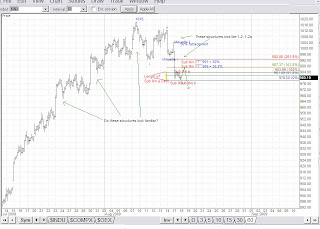

Because this is a blog on EW analysis, I have to present what may be the most probable outcome (at the moment) based on the application of the rules, guidelines and techniques.

Certainly 1159 is attainable, because anything is possible, but what is most probable? Remember, EW analysis is about "limiting the possibilities and then ordering the relative probabilities of possible future market paths". (EWP, pg 95)

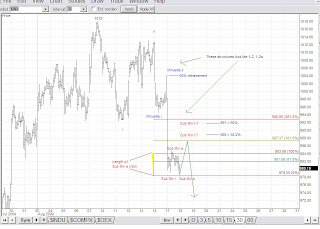

I would say at this point in time the first likely target would be the 1030 - 1070 range to focus on as a possible top. Below are a few reasons why:

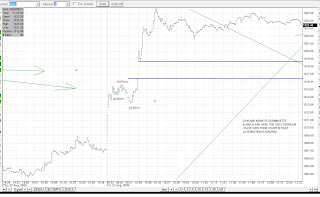

1. On my previous post (

Minute 1 of Y), Minute [v] = Minute [i] at 1030. This places price at the Wave (Y) mid channel line.

If Minute [v] = 1.618 x Minute [i], price ends up approximately near 1040.

2. The previous 4th wave extreme : Based on EW behavior, corrective waves typically terminate in this area.

3. Fibonacci relationships : Wave (Y) = .618x Wave (W), which is considered a very common relationship. This is just 4 SPX points away from the previous fourth wave extreme.

Wave c of (Y) = .618x Wave a of (Y). Either relationships may target the P2 mid channel line or Wave (Y) upper channel line.

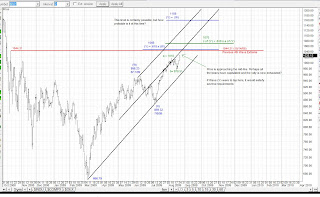

4. The Wave (Y) Upper and Mid Channel Line : If price continued higher over time, it could hit the mid channel line over the next week near the previous fourth wave extreme and (Y) = .618 x (W). If price reached the upper channel line, it would reach the level where Wave c of (Y) = .618 x Wave a of (Y)

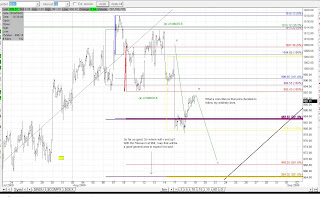

5. The P2 mid channel line : Price targeting the mid channel line would be an acceptable spot. An example of this is the Intermediate fifth wave low of 666.79 back in March.

The Intermediate 5th wave of P1 landed right on it's mid channel line. I take that as a signal that selling pressure at that time became exhausted.

So the same argument may go here. If buying pressure is exhausted, the mid channel line may be as far as she goes. This would be supported by clues #1 and 2 above.

One cannot ignore at this time the potential for price to be attracted to this area given all the relationships mentioned above. I'll be approaching this one level and one wave at a time.

Could P2 have topped on Friday? It is certainly possible as well. However, a signal for me would be if price broke below Wave b of (Y) at 978.51 and further confirmation with a break below the lower P2 channel line.

Click on the links for further reading on

EW Channeling and

Fibonacci relationships for corrective waves.