EOD UPDATE

Things are getting a little tricky here but there are still a few options for the bears and the bulls.

For the shorter term bull count, there are two levels that I'll be watching:

1. 1279.81 is the level to watch if the impulse count up is to continue. See the 10 min chart below for the count in blue.

2. If wave [d] of the triangle is in play, today marked the end of wave w or a** of [d] and the wave x or b pullback began into the close. I expect a 50% retracement for this pullback but anything greater than 62% and I'll place a lower probability to this option. See the Minor 4 Options chart for this view.

** It is also possible to incorporate the impulse count to represent wave a of [d] still in progress.

I will also be watching the trendline connecting the 5/5 - 5/17 lows for a back test target before resuming the move higher.

If either option above fails, the bear option below may be the count in play and 1248 may be in the works.

3 Min

If wave y complete today, it is 1.618*w. The channel above is an EW channel using waves 1-3. See the 10 min chart below for a larger view.

Notice that this count accommodates the wave 4 option on the 10 min chart below or the wave x/b pullback of wave [d] of the triangle.

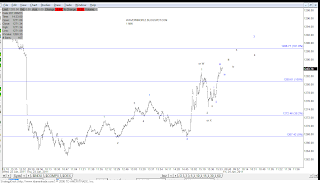

10 Min

The blue channel is an EW based channel projecting for wave 4 using the ends of waves 1 and 3. Notice the market closed right on it today.

60 Min

Keep an eye on the red trendline and the 38-50% retracement level.

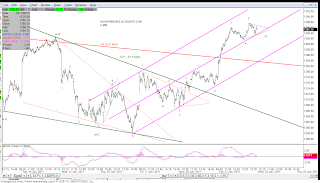

Minor 4 Options

The options are still rolling along.

Daily Bollinger Bands

Rejection at the 20 day SMA. Look at the lower band below, the market may be aiming for 1248 if the bulls don't show up.

Bear Option

A wave (5) down would match up with a target of the lower Bollinger Band.