[1:45 PM Update Squiggles] THE PRIMARY COUNT IS THE LAST CHART BELOW

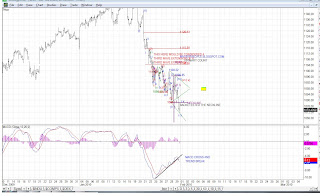

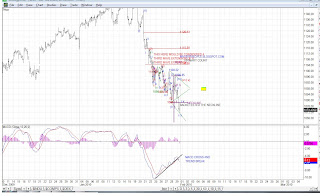

60 min MACD cross and trend break

60 min MACD cross and trend break Squiggle Part 1

Squiggle Part 1 Squiggle Part 2

Squiggle Part 2 Squiggle Part 3

Squiggle Part 3 Squiggle Part 4

Squiggle Part 4 Squiggle Part 5

Squiggle Part 5Ok. I hope this makes sense to you all. The first chart is messy because it is hard to scale down so that you can see the overall picture. I included the chart only to show you the 60 minute MACD. MACD crossed it's signal line and broke below the trend it has established up. I'm treating that as a signal for more downside to come

The subsequent charts highlight the squiggles in parts so that you may see the details. I think I overlapped them enough so that you may see where you are in relation to the previous chart.

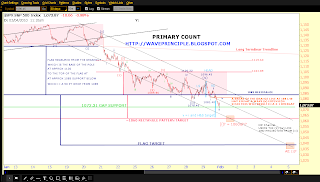

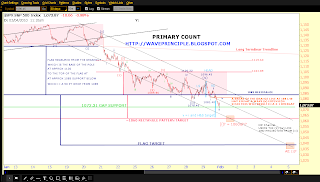

...And that is how I arrived at my primary count below.

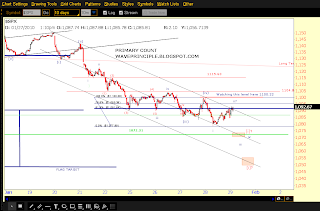

PRIMARY COUNT-1/31/10

PRIMARY COUNT-1/31/10Ok. My eyes are extremely strained at this point. I have spent some time (hopefully not in vain) trying to decipher the squiggles throughout the sideways move. I think it is very important to figure this out because of the overlapping nature of the waves.

For all we know, there may be one more wave iv of some degree working out. This will make all the difference in determining where we should expect wave (v) of minute [i] to complete.

Above is my current primary count. I'm going with this and expecting wave (v) to hit 1060 for the following reasons:

1. Wave v of (v) = i of (v), assuming iv is done.

2. Projecting for wave (v) by utilizing an EW channel. This was achieved by using the (ii)-(iv) line and drawing a parallel to (iii). (v) is expected to hit the lower trendline.

3. The Head and Shoulders expected target arrives at the same level.

4. A valid rectangle pattern arrives at the same level.

Things to consider:

1. Minute [i] may be considered complete.

2. Flag pattern target = 1040s.

3. Wave (v) may extend

**See Note Below**Check back later because I will post charts highlighting the squiggles. There will be several charts in order to capture each segment.

**Note**: In a

previous post, I wrote about an extended wave 3 of an extended wave 3. Given this and typical wave behavior, it was expected that wave (v) would simply equal wave (i). I based this on the following obtained from EWP (pg 32), "The vast majority of impulses contain an extension in one and only one of their three actionary subwaves."

However, it should be noted that this is not a set rule, but more so as a guideline because the rest of the paragraph from the book reads,"The rest either contain no extension or

an extension in both subwaves three and five. So though very rare, we still must keep this in mind as a possibility.

,

,