Stock Market Analysis With The Elliott Wave Principle -Dow Jones, S&P 500, Russell 2000, Nasdaq and FX. All charts and commentary on this site are strictly the opinions of the author(s) and are for recreational purposes only. In no way should this be construed as trading advice or a recommendation for investing. See disclaimer at the bottom of the page.

Sunday, October 31, 2010

10/31/10 - Futures, EUR/USD

So far Option 1 and 2 are in the lead as of now based on futures action tonight. Let's see what the morning brings.

Looks like wave d in progress to me. If wave b is breached, most likely the tri is over and it was actually a running flat.

Saturday, October 30, 2010

MY NEW PREFERRED COUNT

I don't know why I have waited this long to really take a crack at counting the waves off the March 2009 low. I decided to do it tonight because LM posed a question on Danerics blog tonight that poked a hole in the bull count I had maintained for the rally of the March 2009 low so it got me to really drill down at the 15 and 60 min levels.

As you will see below, this is my best effort at the moment, and I think it is very legitimate. I obviously welcome all feedback to ensure I had not missed anything.

I believe you first saw the above chart from my "There Is No Primary Wave 3 Bear" post earlier this month (Please read the post for an explanation of the Fib relationships) . This is my long term primary view. This should help provide some context with how I view the daily count below.

Line charts are nice to view to help filter out some of the noise. As in previous posts, I have mentioned that this does "look" like 5 waves up off the March 2009 low.

But what does it represent? Intermediate (1) or (A)? Who cares, because we know with basic EW, 5 in one direction requires 3 in a countertrend direction before another 5 continues with the previous/prevailing trend.

So as the above chart shows, we may have completed (1) /(A) in April and completed (2)/(B) in July and may be working on (3)/(B) now. The alternate is that we are working on a large flat for (2)/(B).

Here is the breakdown of the daily count. I will work on a series of 60 min charts to provide more details of the subwaves when I get a chance. I have tried to include as many reaction highs and lows to allow one to determine where each wave is located.

I honestly and sincerely welcome all feedback (respectful feedback hopefully) on this count.

As you will see below, this is my best effort at the moment, and I think it is very legitimate. I obviously welcome all feedback to ensure I had not missed anything.

I believe you first saw the above chart from my "There Is No Primary Wave 3 Bear" post earlier this month (Please read the post for an explanation of the Fib relationships) . This is my long term primary view. This should help provide some context with how I view the daily count below.

Line charts are nice to view to help filter out some of the noise. As in previous posts, I have mentioned that this does "look" like 5 waves up off the March 2009 low.

But what does it represent? Intermediate (1) or (A)? Who cares, because we know with basic EW, 5 in one direction requires 3 in a countertrend direction before another 5 continues with the previous/prevailing trend.

So as the above chart shows, we may have completed (1) /(A) in April and completed (2)/(B) in July and may be working on (3)/(B) now. The alternate is that we are working on a large flat for (2)/(B).

Here is the breakdown of the daily count. I will work on a series of 60 min charts to provide more details of the subwaves when I get a chance. I have tried to include as many reaction highs and lows to allow one to determine where each wave is located.

I honestly and sincerely welcome all feedback (respectful feedback hopefully) on this count.

10/30/10 - Weekend Thoughts [EDIT: 4:40 PM]

I'll be posting my thoughts throughout the weekend. Usually I add the most recent posts on top. This weekend, as I add to this post, I will add updates to the bottom to make it easier to follow my thoughts from beginning to end.

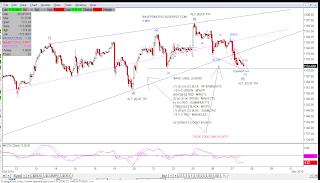

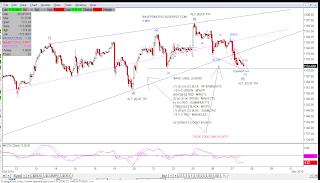

Here's a recap of my EOD post yesterday and the three options I'm looking for next week :

Option 1: Labels in black.

The market completed the triangle today.

Option 2: Labels in blue.

The market is still working on subwave [D] of the triangle and subwave (x) of [D] completed today. Next week, we may get a pop but not break above 1195.35. The range for (y) of [D] could be anywhere from the blue trendline to the green horizontal line above.

Option 3: Labels in pink.

The market is still working on subwave [C] with waves A and B of (y) completing today. A selloff next week would drop the market anywhere below so long as it is not below 1159.71.

The triangle will be deemed complete or voided should any of the two horizontal lines get breached; complete if breached to the upside and voided if breached to the downside.

This chart is a work up of the chart I posted yesterday at 11:48 when I noticed the similar pattern taking place.

Interesting that both patterns completed their triangles on a Friday. Will we see a gap up pop on Monday just like the first one?

If the market continues to repeat the pattern, I'm looking for a move higher targeting the Fib targets ranging from 1193-1205. This matches well with option 1 of the 1st chart above.

However, be mindful of the descending trendline resistance on MACD which would result in a triple negative divergence if we make a higher price high.

There is no denying that a series of three wave structures have played out. The most likely pattern is that of a triangle.

I will add that though I removed the ending diagonal count from the options (see post), I am contemplating bringing it back.

I have been trying to label the rally off the Aug low and the ED still fits the best. Though there is an issue with the ED technically, it still looks like one in form. If anything, odds are still pretty good to consider it as an option since the NDX sports a decent count supporting this option.

I have sent EWI an email to clarify this issue. Not sure if anyone will answer it this weekend. If I get a response, I will certainly update you all.

Why you may ask would I still consider this? Based on the similarity chart above, if we see the thrust up next week, it may represent the last push for wave 5 of the ED.

Whether you want to dismiss it or not, we must be prepared in the event that we see a sharp reversal. I'll post the ED chart later today.

As for what I'm preparing for next, see last weekend's thoughts. Gotta run for now.

[EDIT: 4:40 PM]

Here's the ED option. I have notated the issue above. I believe everything else counts out correctly. Triangle or ED, both imply the same thing at the moment; up and both allow for approximately the same level higher.

Here's the update on the triangle count, which is starting to look like a good barrier (ascending) triangle.

The EUR/USD looks to have completed an a-b-c flat wave 4 and may also be working on wave d up of a triangle.

The US dollar index looks like it completed a wave 4 flat as well but in the opposite direction which would be positive for equities. This of course disregards the glitch on the 22nd.

Friday, October 29, 2010

10/29/10 EOD Update

EOD Update

Another boring day in the market. All I'm waiting for at the moment is to see which green horizontal line breaks first. That is it.

In the mean time, this triangle is done or is playing out and may take some more time if it needs to. Per EWP, pg 52, "Many analysts are fooled into labeling a completed triangle way too early. Triangles take time and go sideways."

The chart above lays out three options that I'm watching for this triangle. Hopefully it's not too confusing.

Option 1: Labels in black.

The market completed the triangle today. In order to avoid being labeled a fool, see options 2 and 3 below

Option 2: Labels in black.

The market is still working on subwave [D] of the triangle and subwave (x) of [D] completed today. Next week, we may get a pop but not break above 1195.35. The range for (y) of [D] could be anywhere from the blue trendline to the green horizontal line above.

Option 3: Labels in pink.

The market is still working on subwave [C] with waves A and B of (y) completing today. A selloff next week would drop the market anywhere below so long as it is not below 1159.71.

The triangle will be deemed complete or voided should any of the two horizontal lines get breached; complete if breached to the upside and voided if breached to the downside.

I'm working on my bear count (related to option 3)and will post some more over the weekend. Until then, this is the focus.

12:50 PM Update

Perfect touch and rejection by the upper descending trendline. We may have just completed wave [D]. One more chance to go long IMHO when we dip for [E].

Perfect touch and rejection by the upper descending trendline. We may have just completed wave [D]. One more chance to go long IMHO when we dip for [E].

However, I will lay out an alternate option based on the 12:44 post.

12:44 PM Update

I still like the 11:48 AM count but wanted to put this one out there too. Need to see the horizontal resistance line break to invalidate that count.

Correction: Need to see 1189.53, the wave a high to invalidate this count.

11:48 AM Update

Remember this pattern? If it's a repeat, I think [D] may still be in progress and turns this triangle into an ascending triangle.

1o:00 AM Update

Triangles everywhere...

8:50 AM Update

I like this option. Looking for that 1177 target.

8:44 AM Update

That 8:18 idea was good while it lasted. C can't retrace a. The other scenario is a flat for y.

8:18 AM Update

I believe we are working on subwave [E] of the triangle and this is a very likely count. Whether we are seeing an a-b-c or w-x-y for [E], c or y is forming a triangle to end the corrective pattern for [E].

This would certainly explain the massive chop we are seeing.

7:05 AM Update

I think [E] is in. However, I would like to see a much larger thrust here.

7:03 AM Update

1180 looks like good support here too and though a little difficult to tell, but c/y of [E] could be counted as complete.

6:58 AM Update

Let's see if c of [E] extends .618*a at 1177. Watching a bounce there and [E] may be deemed complete.

6:45 AM Update

Here are my thoughts on the 5 min.

Pre Market

It appears subwave [E] of the triangle may be in. Now to confirm we need to see a thrust up and out over the upper ascending trendline. Subwave [B] must also be taken out.

1222 looks to be the thrust target for /ES. But keep in mind the alternate is that [C] may still be in progress. As long as [A] is not taken out, [C] may turn into a complex subwave with more whipsawing in store and make for yet another boring day.

Another boring day in the market. All I'm waiting for at the moment is to see which green horizontal line breaks first. That is it.

In the mean time, this triangle is done or is playing out and may take some more time if it needs to. Per EWP, pg 52, "Many analysts are fooled into labeling a completed triangle way too early. Triangles take time and go sideways."

The chart above lays out three options that I'm watching for this triangle. Hopefully it's not too confusing.

Option 1: Labels in black.

The market completed the triangle today. In order to avoid being labeled a fool, see options 2 and 3 below

Option 2: Labels in black.

The market is still working on subwave [D] of the triangle and subwave (x) of [D] completed today. Next week, we may get a pop but not break above 1195.35. The range for (y) of [D] could be anywhere from the blue trendline to the green horizontal line above.

Option 3: Labels in pink.

The market is still working on subwave [C] with waves A and B of (y) completing today. A selloff next week would drop the market anywhere below so long as it is not below 1159.71.

The triangle will be deemed complete or voided should any of the two horizontal lines get breached; complete if breached to the upside and voided if breached to the downside.

I'm working on my bear count (related to option 3)and will post some more over the weekend. Until then, this is the focus.

12:50 PM Update

Perfect touch and rejection by the upper descending trendline. We may have just completed wave [D]. One more chance to go long IMHO when we dip for [E].

Perfect touch and rejection by the upper descending trendline. We may have just completed wave [D]. One more chance to go long IMHO when we dip for [E].However, I will lay out an alternate option based on the 12:44 post.

12:44 PM Update

I still like the 11:48 AM count but wanted to put this one out there too. Need to see the horizontal resistance line break to invalidate that count.

Correction: Need to see 1189.53, the wave a high to invalidate this count.

11:48 AM Update

Remember this pattern? If it's a repeat, I think [D] may still be in progress and turns this triangle into an ascending triangle.

1o:00 AM Update

Triangles everywhere...

8:50 AM Update

I like this option. Looking for that 1177 target.

8:44 AM Update

That 8:18 idea was good while it lasted. C can't retrace a. The other scenario is a flat for y.

8:18 AM Update

I believe we are working on subwave [E] of the triangle and this is a very likely count. Whether we are seeing an a-b-c or w-x-y for [E], c or y is forming a triangle to end the corrective pattern for [E].

This would certainly explain the massive chop we are seeing.

7:05 AM Update

I think [E] is in. However, I would like to see a much larger thrust here.

7:03 AM Update

1180 looks like good support here too and though a little difficult to tell, but c/y of [E] could be counted as complete.

6:58 AM Update

Let's see if c of [E] extends .618*a at 1177. Watching a bounce there and [E] may be deemed complete.

6:45 AM Update

Here are my thoughts on the 5 min.

Pre Market

It appears subwave [E] of the triangle may be in. Now to confirm we need to see a thrust up and out over the upper ascending trendline. Subwave [B] must also be taken out.

1222 looks to be the thrust target for /ES. But keep in mind the alternate is that [C] may still be in progress. As long as [A] is not taken out, [C] may turn into a complex subwave with more whipsawing in store and make for yet another boring day.

Thursday, October 28, 2010

10/28/10 - /ES, EUR/USD and /DX; Bear and Bull Count

Here's a look at my bear count that I have held for quite some time now. This would go with the Option2 count I presented in this post last weekend.

Here's the bull count with the bear option labeled as alternates.

All three are sporting some type of triangle and are in the ending stages before their respective thrusts.

The dollar index sports a triangle inverse to the EUR/USD and /ES. It appears they all need to put in their respective wave Es.

10/28/10 EOD Update

I just wanted to add the StrategyDesk version of the count to include the entire rally off the August lows.

This is the triangle as I see it. The green horizontal lines marks the levels signifying whether the triangle is wrong (lower green) or complete (upper green).

We may still be working on [C] or wrapping up [D] or just getting underway with [E]. Not going to waste my time with the squiggles. I'm long for the thrust and stops are in place if this is not a triangle.

10/28/10 11:20 AM Update

11:20 AM Update

Vodavi brought up a good point earlier this AM in comments regarding a complex wave [C] scenario. I certainly would not disagree with this possibility.

I still have as the preferred count at the moment that we are working on [D].

Until we get a decisive break above 1196.14 or below 1159.71 we should be whipsawing up and down to complete this triangle.

10:07 AM Update

Looks like we may have our break out of the falling wedge for wave b/x of [D].

Targets for this are c/y = a/w at 1195 and c/y=.618*a/w at 1189

9:42 AM Update

Had to step away for a sec. Looks like this may be a falling wedge. Consistent with a wave b or x of [D]

Had to step away for a sec. Looks like this may be a falling wedge. Consistent with a wave b or x of [D]

8:27 AM Update

An hourly MACD buy signal is imminent. The last time we had a cross from under zero was on 10/20. The market made two higher highs from there.

If this repeats, this may target the wave [B] high at 1195 and form the ascending triangle as I have mentioned a day or so ago.

8:05 AM Update

SPX- 5 MIN

SPX- 5 MIN

Here's the 5 min view without the trendlines. MACD is heading up.

8:00 AM Update

Here's a quick 1 min view to show the channel break on that retrace down. Either wave (x) is complete or wave a of (x) is complete.

7:35 AM Update

So far a pause at the 50% retracement level in a three wave down. If this is still an (x) wave of [D], keep in mind that this wave (x) may be a triangle itself so we could potentially bounce around before one more spurt to the upside to complete [D].

7:20 AM Update

Looks like wave [D] of the triangle may be in . Subwave c of [D] = 1.618*a of [D].

I did place a wave (w) at the top of [D] as an alternate because on the hourly chart, the move off [C] does not look like a clear three wave move up.

So we are either working on [E] down now or just (x) of [D].

Here is another example of an EW trade setup. Should we be working on [E] down, a move to 1180-1177 may be bought with a clearly defined stop (below wave [C] at 1171). If the count is correct, one may be able to ride a 20-25 pt move up when this thrusts out of the triangle.

6:50 AM EUR Update

EUR/USD appears to be working out a possible triangle as well. It should coincide with grinding it's way down towards the daily MACD trendline. It may not either and just create a higher low. We shall keep an eye on the histograms.

Pre Market

Here's a look at the futures market. So far the triangle is looking right on track. As I mentioned yesterday, it is possible that wave [D] travels as high as the end of [B] to form an ascending triangle.

The second chart is a closeup and shows the fib relationship of wave c to a of [D]. A .618 ratio gets up 1187 and 1193 if c=a.

Yesterday there was a discussion regarding my ED count in that wave 2 of the ED was not a zigzag (it was a flat), which per rule it should be. I mostly agreed with that argument and dropped the count.

However, I believe the market is still wedging higher and other indices may be sporting a legitimate ED. Ultimately if the market takes out wave [B] of the triangle, we may have to bring this option back to the table as a consideration.

GL today.

Vodavi brought up a good point earlier this AM in comments regarding a complex wave [C] scenario. I certainly would not disagree with this possibility.

I still have as the preferred count at the moment that we are working on [D].

Until we get a decisive break above 1196.14 or below 1159.71 we should be whipsawing up and down to complete this triangle.

10:07 AM Update

Looks like we may have our break out of the falling wedge for wave b/x of [D].

Targets for this are c/y = a/w at 1195 and c/y=.618*a/w at 1189

9:42 AM Update

Had to step away for a sec. Looks like this may be a falling wedge. Consistent with a wave b or x of [D]

Had to step away for a sec. Looks like this may be a falling wedge. Consistent with a wave b or x of [D]8:27 AM Update

An hourly MACD buy signal is imminent. The last time we had a cross from under zero was on 10/20. The market made two higher highs from there.

If this repeats, this may target the wave [B] high at 1195 and form the ascending triangle as I have mentioned a day or so ago.

8:05 AM Update

SPX- 5 MIN

SPX- 5 MINHere's the 5 min view without the trendlines. MACD is heading up.

8:00 AM Update

Here's a quick 1 min view to show the channel break on that retrace down. Either wave (x) is complete or wave a of (x) is complete.

7:35 AM Update

So far a pause at the 50% retracement level in a three wave down. If this is still an (x) wave of [D], keep in mind that this wave (x) may be a triangle itself so we could potentially bounce around before one more spurt to the upside to complete [D].

7:20 AM Update

Looks like wave [D] of the triangle may be in . Subwave c of [D] = 1.618*a of [D].

I did place a wave (w) at the top of [D] as an alternate because on the hourly chart, the move off [C] does not look like a clear three wave move up.

So we are either working on [E] down now or just (x) of [D].

Here is another example of an EW trade setup. Should we be working on [E] down, a move to 1180-1177 may be bought with a clearly defined stop (below wave [C] at 1171). If the count is correct, one may be able to ride a 20-25 pt move up when this thrusts out of the triangle.

6:50 AM EUR Update

EUR/USD appears to be working out a possible triangle as well. It should coincide with grinding it's way down towards the daily MACD trendline. It may not either and just create a higher low. We shall keep an eye on the histograms.

Pre Market

Here's a look at the futures market. So far the triangle is looking right on track. As I mentioned yesterday, it is possible that wave [D] travels as high as the end of [B] to form an ascending triangle.

The second chart is a closeup and shows the fib relationship of wave c to a of [D]. A .618 ratio gets up 1187 and 1193 if c=a.

Yesterday there was a discussion regarding my ED count in that wave 2 of the ED was not a zigzag (it was a flat), which per rule it should be. I mostly agreed with that argument and dropped the count.

However, I believe the market is still wedging higher and other indices may be sporting a legitimate ED. Ultimately if the market takes out wave [B] of the triangle, we may have to bring this option back to the table as a consideration.

GL today.

Wednesday, October 27, 2010

10/27/10 - Triangle Update

I'm reposting this triangle chart since I didn't have access to my StrategyDesk platform earlier when I posted the EOD update.

The top chart was posted on Saturday 5/23, Weekend Thoughts. When I posted that chart, I speculated on how we would arrive at this triangle.

I didn't get a chance to look at this exact chart at EOD and posted with TOS earlier tonight. Take a look at the end result. Coincidence? Man that's pretty cool.

Earlier I posted that [D] may retrace 61-81% of [C] but it can very well travel back to the beginning to form an ascending triangle as speculated in the first chart above.

Anyway. I know this post is redundant but wanted to stress that perhaps this is what the market wants to do.

I just wanted to add some channel support

I just wanted to add some channel support

Alternate Counts

I've mentioned that I've kept an eye on several counts as i've tried to speculate where the market may head.

The chart posted above is an update to the count I posted back in May using TOS. You can see these alternate counts here. The link is also at the top of my blog.

I believe an expanding diagonal in the 5th wave position like this is a very bearish pattern.

Does wave c of 5 stop shy of the blue trendline or are we headed for it?

Here's the Updated Strategy Desk version.

Feedback and comments are welcome on this count.

10/27/10 EOD UPDATE

EOD UPDATE

As suspected in this morning's post at 6:38 AM, the triangle option was pushed into the spotlight. The selling that occurred pushed the trendlines of the ED apart to the point where I no longer believe it to be an ED. (Granted there is one other issue with the count to begin with as seen in the comments section of my post earlier today.)

Irregardless of the ED count, the triangle was the backup count I was watchingbecause of the overlapping nature of the waves so I was still confident the selling would be contained and if it weren't then both options would've been off the table. I pondered this option last Saturday here.

So where do we head from here? Subwaves in triangles typically retrace 61-81%. Given that level of retracement, wave [D] can travel as high as 1186-1191 before subwave [E] kicks in lower. The target for this triangle thrust, should one come, is approximately 1228.

So what invalidates this count? Pretty simple.

The market should not drop below what I have labeled as wave [C]. If it does, it was not a triangle.

Should the market rally above wave [B], the triangle will be out and the correction would be considered a running flat wave (iv).

Notice the hourly MACD is minutes away from a buy signal cross up.

Gotta run for now. I'll get some more charts up later tonight.

As suspected in this morning's post at 6:38 AM, the triangle option was pushed into the spotlight. The selling that occurred pushed the trendlines of the ED apart to the point where I no longer believe it to be an ED. (Granted there is one other issue with the count to begin with as seen in the comments section of my post earlier today.)

Irregardless of the ED count, the triangle was the backup count I was watchingbecause of the overlapping nature of the waves so I was still confident the selling would be contained and if it weren't then both options would've been off the table. I pondered this option last Saturday here.

So where do we head from here? Subwaves in triangles typically retrace 61-81%. Given that level of retracement, wave [D] can travel as high as 1186-1191 before subwave [E] kicks in lower. The target for this triangle thrust, should one come, is approximately 1228.

So what invalidates this count? Pretty simple.

The market should not drop below what I have labeled as wave [C]. If it does, it was not a triangle.

Should the market rally above wave [B], the triangle will be out and the correction would be considered a running flat wave (iv).

Notice the hourly MACD is minutes away from a buy signal cross up.

Gotta run for now. I'll get some more charts up later tonight.

10/27/10 11:50 AM Update

11:50 AM Update

Ok. There have been some comments going on back in forth regarding my larger ED and the blue ED above.

I welcome those comments because if my count is wrong, I wanna know. I have not ego when it comes to this stuff. If I'm wrong, I'm wrong. We all just want to be on the right side of the trade.

The point on the larger ED is that wave [2] up is actually a flat vs a zigzag, which per EW, must be a zigzag. I accept that.

Keep in mind, that only strengthens the triangle alternate that I have laid and have been watching as well since we continue to see overlapping corrective waves.

The chart above highlights the fact that we have not seen five waves down off the Monday high since they would be considered a 4-1 overlap.

I highly doubt that it is a nest 1-2 down either. That would be three in row.

I have to run for the rest of today but let's just say for now my triangle alternate has stolen the spotlight from the ED again.

So we should be working on wave [D] up now. A 62% retrace of [C] takes us to approximately 1186.

For those who came by to read and comment/feedback, I appreciate it. I'll try to catch up to your questions later tonight.

GL! Last hour of trading!

10:20 AM Update

10:15 AM Update

I think I really like this larger ED pattern. Working on (v) down now. Gonna go long here in a sec.

8:55 AM Update

Now that we are talking about ending diagonals, there is another option to watch for. Perhaps a larger ED down is playing out to complete wave [4] or C of the triangle.

I have highlighted it above with the blue converging trendlines. This is still too early to tell but something to keep in mind.

Thanks Vodavi! I think this is how it should count. Great catch! Wave (c) ends with an ending diagonal.

I wish I had checked comments earlier. Folks, if you have counts going and think you can contribute, please do so.

8:15 AM Update

I added the Triangle count to this chart. An I think I finally see five waves down for (c).

The ED and Triangle still remain on the table. Obviously (c)=(a) may be the ratio of the day.

Break below the green line and things start favoring the bears a little more.

7:40 AM Update

I think (c) of [4] may be in or one more little push down to 1175. I see a positive MACD divergence on the 1 min.

Until 1171 breaks, we either begin wave d of the triangle or [5] of the ED up.

6:50 AM Update

I updated the trendline to better reflect that off the 60 min chart. So far she is holding.

6:45 AM Update

Here's the 60 min view. The ED is still in tact as long as we hold here.

6:38 AM Update

So far we have some buyers stepping in to support the 1180 area.

If the above 5 min view is correct, which is a closeup of the alternate view below, c=.618*a.

With this AM's selloff, the ending diagonal count may be in jeopardy if we fall further because the converging trendlines will start to widen which begins to lend more support to the triangle option.

Keep in mind, triangles take time and typically wave Cs in triangles tend to be complex (meaning a lot more whipsawing to come).

Pre Market

Looks like futures is confirming the alternate I presented in yesterday's EOD post. 1175 has c=.618*a and c=a at 1166.

As posted yesterday 1171 and 1159 (cash) are the numbers to watch if the ending diagonal or triangle counts are to remain valid.

I think we will have more whipsawing again but also keep in mind my CCI chart I posted yesterday and last Saturday.

Ok. There have been some comments going on back in forth regarding my larger ED and the blue ED above.

I welcome those comments because if my count is wrong, I wanna know. I have not ego when it comes to this stuff. If I'm wrong, I'm wrong. We all just want to be on the right side of the trade.

The point on the larger ED is that wave [2] up is actually a flat vs a zigzag, which per EW, must be a zigzag. I accept that.

Keep in mind, that only strengthens the triangle alternate that I have laid and have been watching as well since we continue to see overlapping corrective waves.

The chart above highlights the fact that we have not seen five waves down off the Monday high since they would be considered a 4-1 overlap.

I highly doubt that it is a nest 1-2 down either. That would be three in row.

I have to run for the rest of today but let's just say for now my triangle alternate has stolen the spotlight from the ED again.

So we should be working on wave [D] up now. A 62% retrace of [C] takes us to approximately 1186.

For those who came by to read and comment/feedback, I appreciate it. I'll try to catch up to your questions later tonight.

GL! Last hour of trading!

10:20 AM Update

10:15 AM Update

I think I really like this larger ED pattern. Working on (v) down now. Gonna go long here in a sec.

8:55 AM Update

Now that we are talking about ending diagonals, there is another option to watch for. Perhaps a larger ED down is playing out to complete wave [4] or C of the triangle.

I have highlighted it above with the blue converging trendlines. This is still too early to tell but something to keep in mind.

Thanks Vodavi! I think this is how it should count. Great catch! Wave (c) ends with an ending diagonal.

I wish I had checked comments earlier. Folks, if you have counts going and think you can contribute, please do so.

8:15 AM Update

I added the Triangle count to this chart. An I think I finally see five waves down for (c).

The ED and Triangle still remain on the table. Obviously (c)=(a) may be the ratio of the day.

Break below the green line and things start favoring the bears a little more.

7:40 AM Update

I think (c) of [4] may be in or one more little push down to 1175. I see a positive MACD divergence on the 1 min.

Until 1171 breaks, we either begin wave d of the triangle or [5] of the ED up.

6:50 AM Update

I updated the trendline to better reflect that off the 60 min chart. So far she is holding.

6:45 AM Update

Here's the 60 min view. The ED is still in tact as long as we hold here.

6:38 AM Update

So far we have some buyers stepping in to support the 1180 area.

If the above 5 min view is correct, which is a closeup of the alternate view below, c=.618*a.

With this AM's selloff, the ending diagonal count may be in jeopardy if we fall further because the converging trendlines will start to widen which begins to lend more support to the triangle option.

Keep in mind, triangles take time and typically wave Cs in triangles tend to be complex (meaning a lot more whipsawing to come).

Pre Market

Looks like futures is confirming the alternate I presented in yesterday's EOD post. 1175 has c=.618*a and c=a at 1166.

As posted yesterday 1171 and 1159 (cash) are the numbers to watch if the ending diagonal or triangle counts are to remain valid.

I think we will have more whipsawing again but also keep in mind my CCI chart I posted yesterday and last Saturday.

Subscribe to:

Posts (Atom)