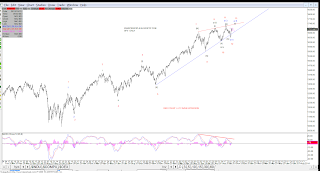

By the EOD yesterday, the wave count was anticipating a move higher, which the market provided and then some.

The green option has been brought back because there is no denying that the bounce off yesterday's low is an impulsive wave. The market also broke out decisively out of the descending channel and is up against the 20 day SMA again.

With five waves up, I will be looking to position (long) again after another higher degree wave 2 or B pullback is complete. A short trade could also be taken to ride a wave 2 or b down (possibly to 1670?).

A larger inverted head and shoulders could be in the works. A symmetrical right shoulder would have the pullback near 1670 but I wouldn't be surprised if any pullback from here is shallow.

The purple option is not quite out yet but is starting to become suspect. The red option is seriously suspect so I'd keep an eye on the daily extended chart below.

The bears need to take out yesterday's low in order to continue their momentum.

|

| 3 Min |

|

| 15 Min |

|

| Daily - BB |

|

| Daily - Extended Option |