[2:48 PM Update]

|

| 5 Min |

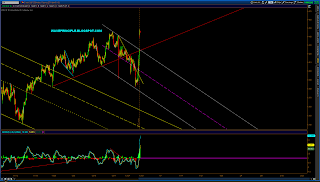

Here's a chart why bulls short term still have a chance to push for another high even though the bounce off today's low was choppy.

[EOD Update]

The bear case:

1. The bounce off the day's low is quite overlapping.

2. Price still within the descending channel.

3. 2 H/S patterns developing

The bull case:

1. The move off the 1/4 high is corrective

2. The bounce off today's low, though corrective, put in higher highs and higher lows.

3. The minimum retracement target was met at 23.6%

Though I'd like to see one more leg down for c of (y), per the 5 min chart, I think I will side with the bulls at the moment unless today's low at 1451.64 is broken.

|

| 5 Min |

|

| 60 Min |