Happy New Year indeed if one were positioned for the fiscal cliff (FC) "resolution" "surprise". I

mentioned on 12/24, there was more room for a surprise FC resolution vs the fear of not resolving it.

Intraday on New Year's eve, we were looking at the completion of the move down off the 12/18 high. Whether you position yourself for a wave 2 bounce or a new leg up, it has payed out handsomely.

|

| 5 Min |

Not gonna concentrate too much on the squiggles but there is room to extend based on this count. However, the hourly chart below, one can slap a wave {i} completion coming up here near 1465.

|

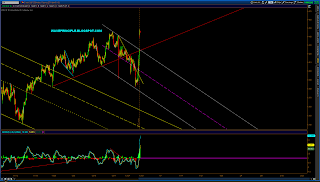

| 60 Min |

A backtest of the inverted H/S neckline is near 1442-1437, which would be a wave {ii} retrace into 38%.

|

| Daily |

Gotta buy/add on the next dip.