[6:50 PM UPDATE]

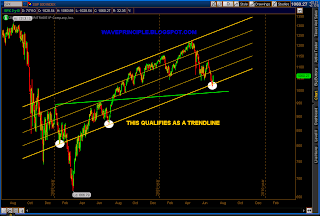

Remember this chart? I posted this on 7/2. So far the market has respected the lower channel. Will it crawl back up? Stay tuned...

------------------------------------------------------------------------------------------------------------

SPX BEAR COUNT

I made some adjustments to the count. I think with the divergences and the rally, it counts much better as (i) complete and (ii) in progress now.

1071-1085 look like good targets for a minuette (ii) bounce if this is what is playing out. SPX BULL COUNT

Some adjustments were made on this count as well. As with the bear count, we are looking for a corrective bounce but instead of a minuette (ii), it is a minuette (b). 1071-1085 would serve as a good target as well.

However, take note of the alternate labels because if the bounce is much greater that 1085, I would most likely go with the alternate count.

SPX MAs

SPX MAsA close above the 13 day SMA. A MACD positive divergence clearly forming and a solid close over the head and shoulders neckline.

Obviously there is still some serious overhead resistance above. Let's see what the market wants to do into earnings next week.