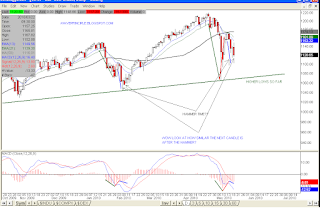

SPX - 60 MIN PREFERRED

SPX - MINOR C ENDING DIAGONAL OPTION

SPX - 60 MIN BEAR COUNT

SPX -CANDLES

SPX - 60 MIN BOLLINGER BANDS

Today was definitely a day for the bears. That inverted head and shoulders is off the table, however that diamond pattern may not be. It just may be getting a little larger.

The market attempted to re-capture 1150 but was unsuccessful today. I still believe we are seeing a series of 3-wave structures up and down creating this range bound action.

My first chart above is my preferred count. I have minute [i] completed with the pullback working an a-b-c structure.

My bear count and alternate count (Minor C ending diagonal) are above as well.

The fourth chart is something I have previously posted. I have compared the Feb hammer with the hammer that printed yesterday. Though a confirmation today of that hammer would have strengthened the case for the bears, notice the candles that printed following both hammers. Again, without confirmation, this cannot be considered a reversal.

The last chart is a 60 minute Bollinger Band chart. The bands are starting to tighten so it is possible a move is coming. I would wager that that may be up. We'll see.

chart. The bands are starting to tighten so it is possible a move is coming. I would wager that that may be up. We'll see.

No comments:

Post a Comment