[9:28 PM PST Update: Euro on Fire]

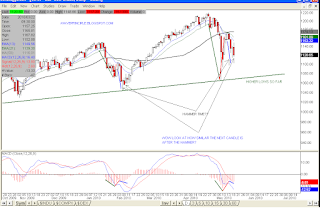

Remember this chart from last night? Let's see what happens at 1.27. That is the head and shoulders target.

The green line is the very large neckline I posted on a 5/16. See chart here for the larger overall count.

Apparently SPX E-minis is reacting to this move as well. How does it fit into the count. See below. Either a wave C of iv up tomorrow at the open or maybe we bottomed. But hey it's OPEX, should be interesting.

Clearly the bears are in control; for now. The 21 day EMA is below the 34 EMA and both are just about pointing straight down and the market closed well below the 200 day SMA.

Above is my bear count. 1050 SPX looks like a minimum target at the least, which based on the count, would complete minuette (iii) of minute [v]. The alternate is that this is only minuette (iii) of minute [iii].

Because I can still show a bull count along with the bear above, I am still waiting to see a death cross, 50 under 200 day SMA, before truly turning on the bear case. Keep in mind, even though I show a bull count, the bull count still allows for more downside to come so both are worth watching.

All I can say is just remember July 2009. Many were convinced that P3 was here. Additionally, it was like overnight the headlines on the financial news websites became very bearish. Just something to keep in mind.

So with that being said, here is my bull count.

I still consider the move down off 1219 as a 3 wave structure. I made some changes to the degrees but show the panic low as minute [a] of Minor B. The rally from there to 1173 is minute [b] and now we are working on a 5 wave structure down for minute [c]. Notice how this 5 wave structure down also matches up with the bear count down?

So though one may feel bearish (myself included), just keep in mind the potential for this bull count.

Here's another chart I've posted in the past showing the golden cross back in Jun 2009.

So the game plan for now is that the bear and bull count is looking for 5 waves down. So from a trading perspective, nothing is different. Eventually a bounce is going to occur, wave 2 if using he bear and wave 1 if using the bull count.

The difference in those two waves will tell us the story. Wave 2s are usually zigzags (a-b-c three wave structures) and are sharp. Wave 1s are just simple impulse (5 wave structure) waves. Hopefully when the time comes, the wave structure will help tell the story along with the MAs at that point.

Oh, almost forgot this other potential count that still works:

GL!